Will you become the monster you are slaying?

Feb 01, 2022When John Kay invented the flying shuttle in 1733, which doubled the output of a weaver, he had no idea he was setting in motion one of the biggest disruptions in history. Within 100 years new mechanized forms of textile production combined with Britain’s existing maritime power to create an economic hegemon, dominating global manufacturing, trade and finance. This lead was short-lived. Germany, Russia and finally American caught up and overtook Britain’s industrial leadership. Now China is doing the same to America. Such is the fate of nations.

This is also the fate of companies. Netflix has announced it is trialling Netflix Direct, a scheduled programme service, in France. On one level this is entirely logical. Netflix’s North Star is to have something to watch for every occasion. If its algorithms and interface do not work in France because people are, well, French, then they should provide the ‘lean back’ service they want.

On another level, this is extraordinary. It would have been unthinkable a few years ago, when Netflix set about disrupting the world of scheduled programming. They are not alone. Almost a quarter of Airbnb’s properties are now operated by companies. Amazon is busy opening physical book and grocery stores. Even uber is operating more and more like a traditional taxi firm, with operators taking calls. Perhaps Spotify plans to sell CDs and Monzo open a bank...

What is going on?

Firstly, companies are responding to changing (or unchanging) patterns of customer behaviour. Customers are reeling from the paradox of choice. 49% US Netflixers find content overload makes choice difficult, and the same number give up if they can’t find what they want in a few minutes (Statista). 47% are frustrated by the number of services required to watch what they want to see (Deloitte), and 70% say there are too many subscription services to choose from (TV Time and United Talent Agency). Disruption by one company is good. Disruption by many is less welcome.

Secondly, there is competitive pressure. Britain had a smaller population, fewer natural resources and greater communication barriers than European and transcontinental rivals. It was always going to be overhauled. Netflix has to take on a host of other disrupters and incumbents, like the BBC, who understand the need to fight back. Netflix’s latest user growth is below plan and they have downgraded net addition targets for 2021. As competition at the core becomes more intense, it is only natural they look at other segments. Offering traditional services like scheduled programming makes sense. Especially if the disruptor’s business model is not yet profitable. They must follow the money. If fintechs need to sell mortgages to prosper, then expect virtual branches as applicants still require face-to-face interaction.

Thirdly, there are cultural factors. One of the reasons why Britain surrendered its industrial lead so quickly was because entrepreneurs did not have the same social prestige as they did in other countries. So when someone in industry made a fortune, they bought a country pile and sent their children to public schools. Rather than re-investing their capital and ‘entrepreneurial spirit’, they withdrew it and became landed pseudo-aristocrats. It is natural for later-stage companies to become more conservative. They are run by accountants and have to offer predictable results to Wall Street. Bigger companies tend to find it harder to innovate than smaller, more agile ones. Successful entrepreneurs start to see the world differently. How much time does Mark Zuckerberg spend on solving customer problems versus managing investors and M&A deal flow? Less than he did at Facebook’s inception.

We don’t know what lies behind each decision to come ‘full circle’ and offer the very services that companies had been hell-bent on attacking. We do know that there is a lesson here for all founders: value creation is not static. It is dynamic. It evolves.

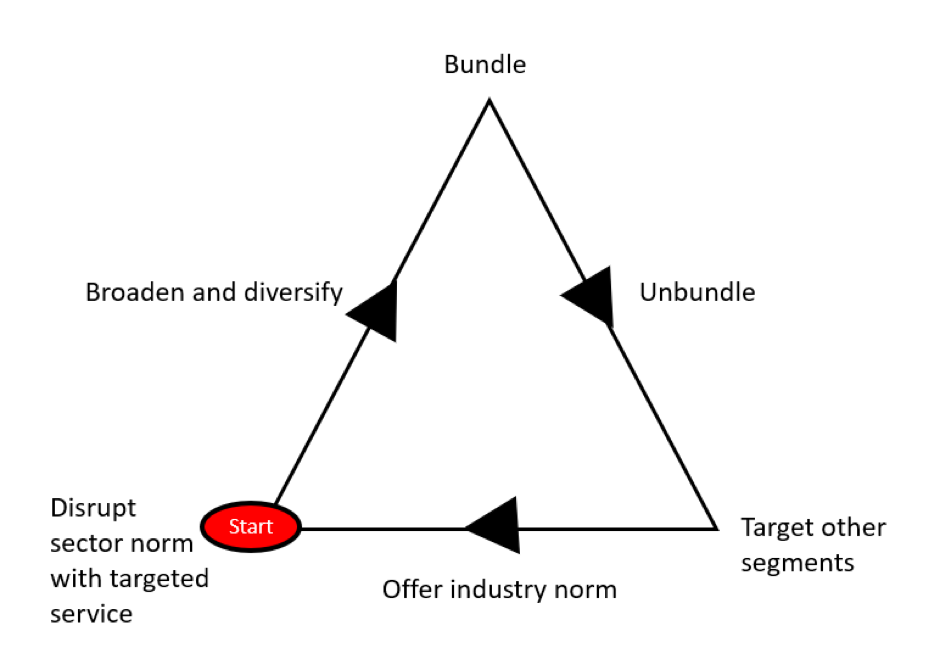

Based on the experiences of some of the tech giants, here is a visualisation of what your path might be:

The two questions founders need answers to are:

· Where are you on your path of value evolution?

· What are you going to do next?

We have created a simple tool to help you map out your future. Get in touch and we will send it to you.

You must stay in control of your own destiny, with a clear sense of purpose and direction. Otherwise you will awake one morning to have become the very thing you defined yourself against. As the prophet of gloom, Friedrich Nietzsche, once said: ‘Whoever fights monsters should see to it that in the process he does not become a monster.’

UP AND TO THE RIGHT.