More tool goodness...

U2R Market Spotter

How you define your market is critical. Investors won't invest unless they understand and are excited by it. The U2R Market Spotter takes you through the process of defining markets using the most common approach (TAM, SAM and SOM). It will also help you to come up with the right descriptions, so you can explain it and find the right market data more easily.

U2R Market Sizer

Once you have defined your markets you need to know if they are big enough. How large are they today? How big will they be in five years' time? The U2R Market Sizer guides you through the process of a 'bottom-up' quantification. The tool automatically calculates your CAGR and uses your margin to gauge whether the market is likely to excite VCs.

U2R Timing Validator

Everyone knows that timing is an important determinant of start-up success. But how do you convince investors yours is spot on? The U2R Timing Validator uses the WAS/NOW/WILL framework to tease out the important market trends and shifts that are creating opportunity and propelling you to ultimate victory. Use the output to construct a brilliant timing story.

U2R Ask Validator

You're asking investors for fundraising, but how do you know if your request is in a ballpark they will recognise? They don't assume your business is already worth $1m, even if you are convinced it is. The U2R Ask Validator uses several types of common valuation methods used by investors, to give you an idea of what your start-up is worth. You can use this to optimise the balance between the amount you ask for and the amount of equity you have to surrender.

U2R Milestone Maker

The most successful fundraisers raise enough to reach their second round of fundraising. This is usually triggered by reaching a significant business or financial milestone. The U2R Milestone Maker helps you understand what this might be, both so you know when you may be in a position to raise again (so you ask for enough this time), and you are focused on what you are going to achieve. This is the success you are selling to investors. The tool also helps link your ask to specific interim goals.

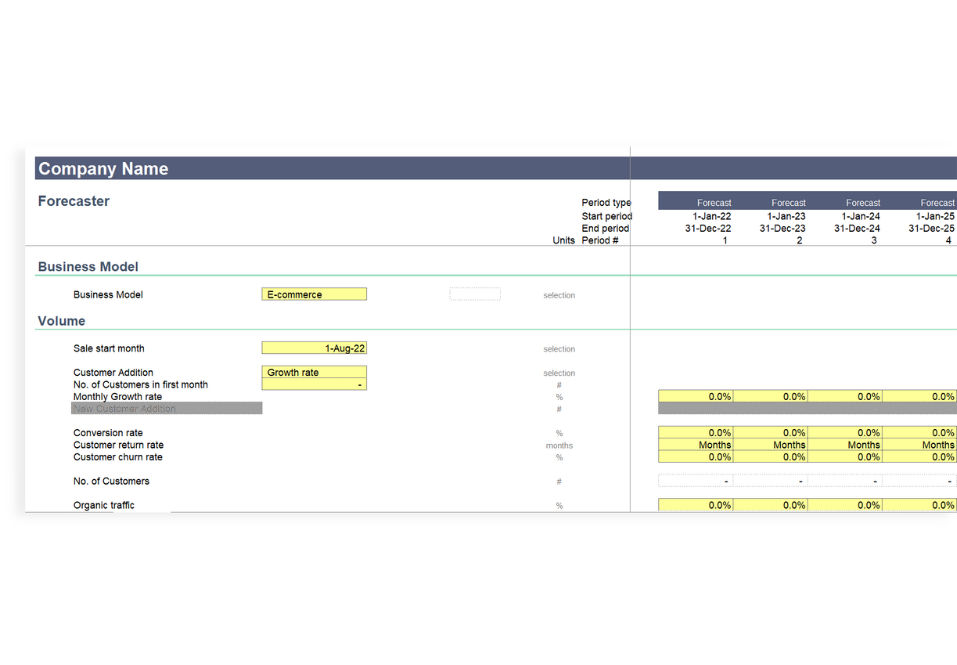

U2R Forecaster

This is the first part of the financial modeller. A financial model is only as good as the data that is entered into it. The U2R forecaster explains every input and makes sure you have all the data you need to begin your financial modelling, from business model, revenue and customer acquisition costs through to costs and CAPEX.

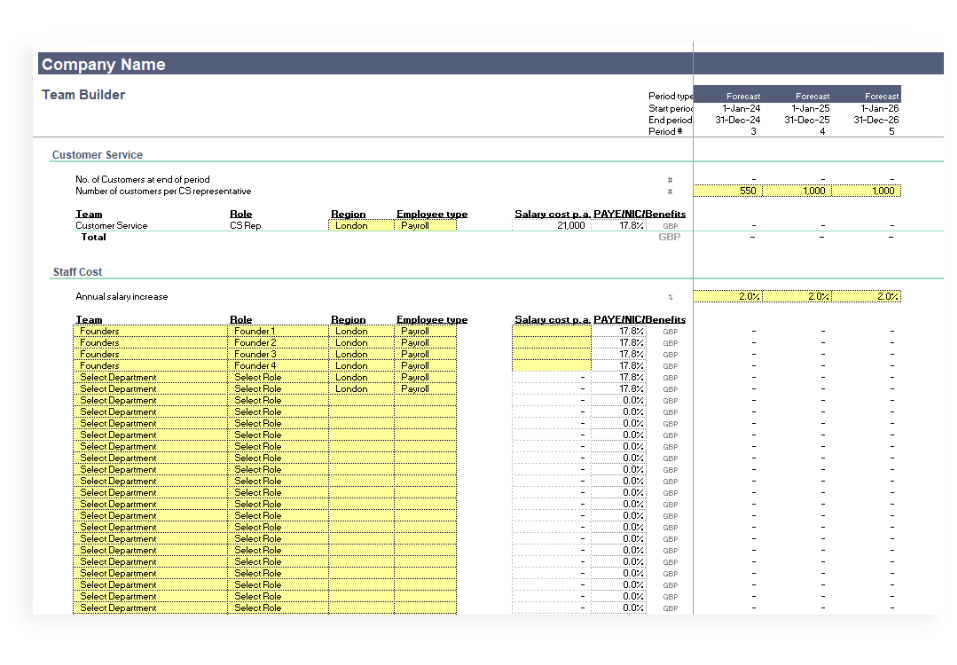

U2R Team Builder

One of the most important drivers of your financial model is your future staff plan. How many people will you need? What will they do? How much will they cost you? The U2R Team Builder is the second part of the Financial Modeller. It helps you quickly build a robust staff plan based on common roles, salary benchmarks and weightings for different locations.

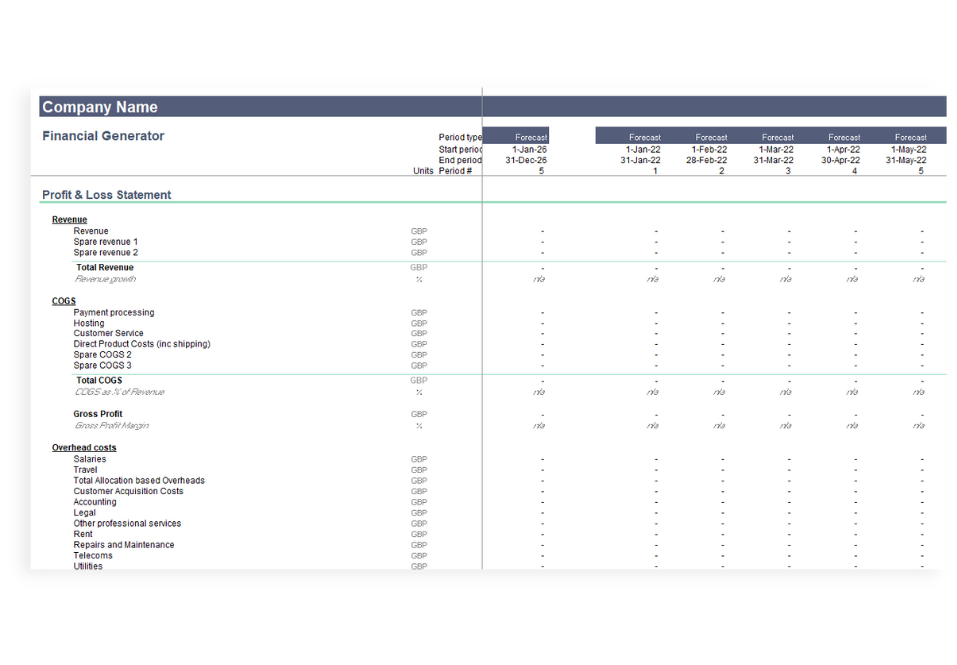

U2R Financials Generator

The third part of the Financial Modeller, this automatically generates full profit and loss, cashflow, and balance sheets for the next five years, based on the forecasts and team you inputted. This will give you a wealth of detail about your projected performance over the next five years, and enables you to use the other tools to model the effects of changes to different inputs.

U2R Financials Dashboard

This is the fourth part of the Financial Modeller. This is a dashboard of charts which visualise key elements of your financial plan, such as the ratio of revenue and customer growth, revenue to cost, revenue to EBITDA and your closing cash balance. These charts will help you to understand key financial dynamics and identify where there may be issues, either because of excessive or insufficient growth. The tool comes with detailed guidance on what to look for in your model.

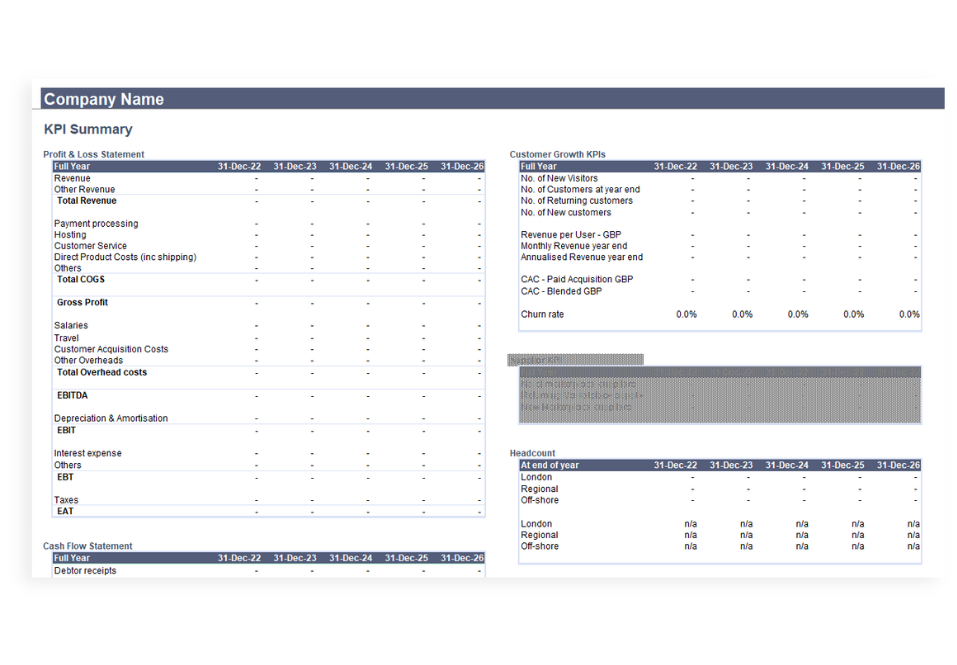

U2R KPI Summary

The fifth part of the Financial Modeller, this KPI summary gets to the core of your financial model. KPIs are extracted from your core financials so you can decide whether they are good enough (or to good). It includes an easy to absorb summary P&L and tables showing customer growth and acquisitions costs, headcounts and margins over the next five years. Go back and make changes to your model inputs until the dynamics are right. This will also help you to complete your Business Model slide.

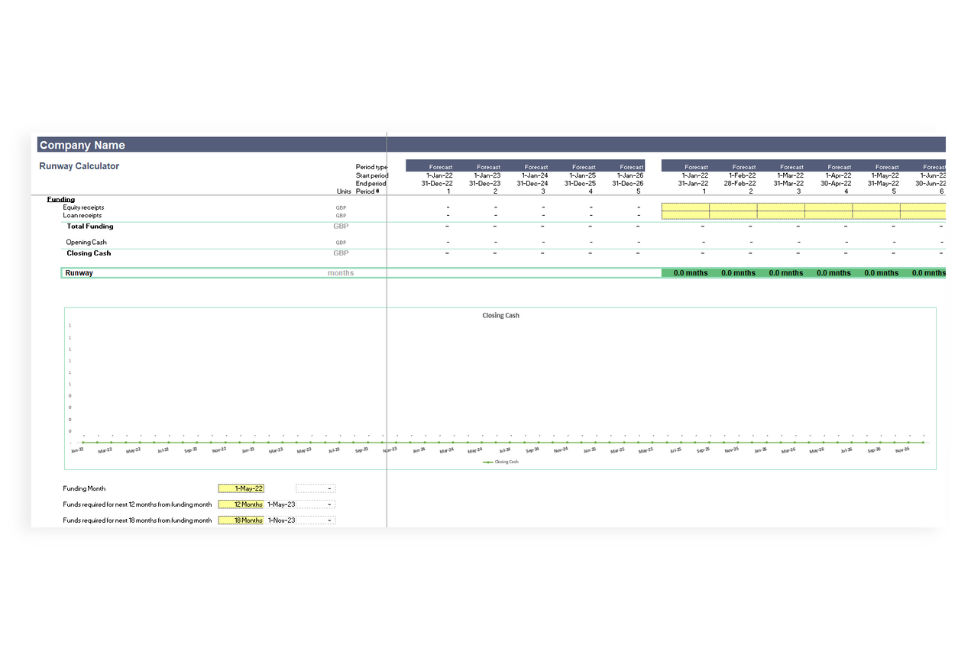

U2R Runway Calculator

The sixth part of the Financial Modeller is the Runway Calculator. The Financials Generator automatically calculates your cashflow, which can be used to plan your long-term fundraising strategy. The Runway Calculator automatically calculates how much runway you have each month and what you need to ask for for 12/18/24 month runway (from a given date). It also lets you model the impact of different amounts and types of fundraising over time, helping you to refine your long term strategy.

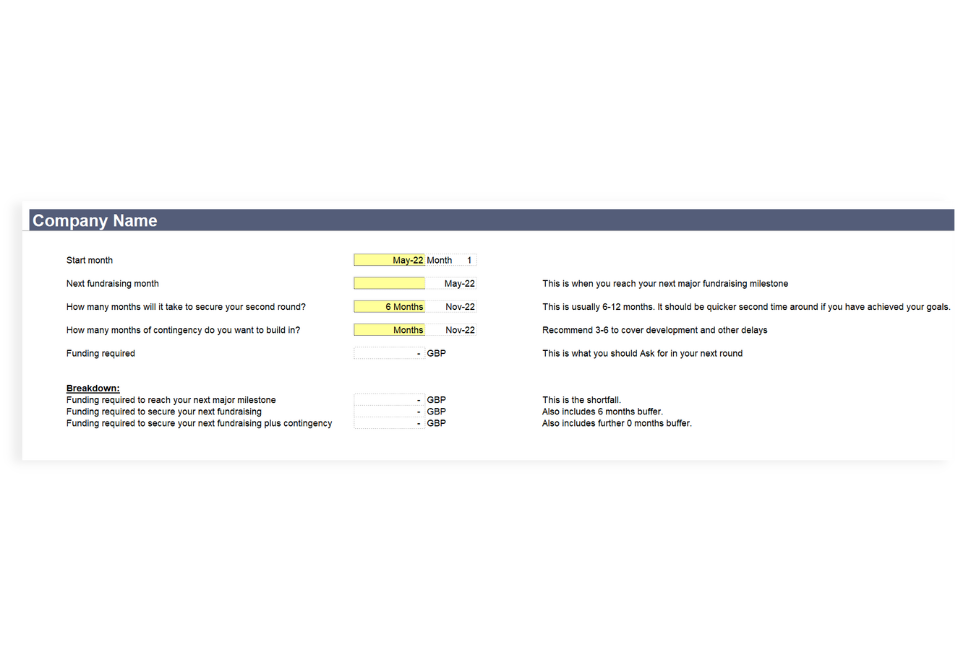

U2R Ask Generator

The seventh part of the Financial Modeller is the Ask Generator. Your closing cash balance and Runway Calculator will give you a good idea of when you might need to raise funds. Calculating exactly how much you need is a difficult task. The Ask Generator makes this simple by calculating the cash shortfall between two dates, such as when you are going to start fundraising now and when you will be able to raise in the future. It also guides you through some key variables so you can decide how much contingency you need. The tool helps you calculate your ASK with much greater precision.